October 20, 2025

Co-buying homes continues to be a rising trend among the Gen Z and Millennial crowds, both for those young entrepreneurs looking to become real estate investors and friends searching for ways to manage the costs of homes.

NPR recently chronicled the story of two California non-romantic partners, Tammy Kremer and Hayley Currier. In their late 30s, the longtime friends couldn’t find a way to afford a home on their own, so they teamed together to purchase a house after rooming together in a rental for nine months.

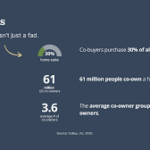

They’re not alone. According to the site CoBuy, a company developed in 2016 to foster joint home purchases, more than 61 million Americans co-own a home with someone who isn't their spouse—nearly 20% of the population. It’s a particular trend with Gen Z and Millennials. A Bankrate 2024 survey found that 14 percent of Millennial homeowners were more likely to have purchased a home with one or more friends while only 4 percent of Gen X and 1 percent of Baby Boomers fall into the same category. Another report from insurance agency JW Surety Bonds found that Generation Z, at 70 percent, leads when it comes to willingness to co-buy with a friend.

“Co-buying and co-ownership aren’t just alternatives,” the company’s site states. “They’re essential paths to modern homeownership. Today, 30% of all US home sales are to co-buyers — a transformative shift in how Americans approach housing.”

One of the reasons the trend – CoBuy calls it a movement – continues to grow is because of affordability. Housing prices have ballooned by more than 50 percent since 2020. Additionally, couples with a combined income tend to have an advantage over singles, and more young people are opting to delay marriage.

A Zillow analysis found that a couple in the U.S. earning the median income can afford nearly quadruple the number of listings as an individual buyer can. Co-buying can level the playing field for singles.

" We've heard of more buyers having to team up to be able to afford a home," Redfin chief economist Daryl Fairweather told NPR. " This is a story that we've been hearing for a long time because affordability [is a real issue]."

Co-buying also can be an option for investors looking to partner. Business Insider recently chronicled the story of three New York men in their mid-20s, Cole Flynn, Stephen Gollisz and Scott McKinnon, who teamed to purchase a home in Tampa near the University of South Florida.

“We each had some money in the stock market but also decided we wanted to get into real estate,” Gollisz told Business Insider. “However, individually, none of us had the money to purchase a property on our own. That's why the idea of co-purchasing a home looked appealing to us.”

The trio uses the home for long-term rentals and McKinnon currently lives in the home with his wife. They’re paying rent while looking to purchase their own home.

The co-buying process is not without challenges. As Kremer and Currier entered into the process, Currier’s mother listed key questions that needed to be answered and ended up with a list of nearly 30.

CoBuy lists six challenges that co-buyers need to address: co-buying agreements; finances, expenses, and payments; documentation and record-keeping; roles, rights, and responsibilities; exit strategies and risk protections.

Flynn, Gollisz and McKinnon vaulted some of the legal challenges by creating an LLC to purchase the Tampa home. They have a bank account attached to the LLC that they all deposit into, and they have divided home ownership duties.

Given the complexities of co-buying, home builders, mortgage lenders, and others in the real estate business might be wise to formulate guidance for those friends who want to go in together on a house.