Posts by mwoolley_specialevents@tbba.net

Tampa Bay Partnership Shares Insights about Region’s Housing Gap

Tampa Bay Partnership Shares Insights about Region’s Housing Gap Back to Blog February 24, 2026 A new report from the Tampa Bay Partnership estimates that Hillsborough, Pinellas, and Polk counties will need to add 254,700 over the next 10 years to meet the projected housing demand. The Housing Equation: A Deep Dive examines the existing…

Read MoreThe 2026 Great Debate about Built to Rent Homes

The 2026 Great Debate about Built to Rent Homes Back to Blog February 24, 2026 One of the great housing industry debates of 2026 may center on institutional investors and their impact on housing affordability. The arguments will ping pong between critics who say corporations that buy homes to turn them into rentals are squeezing…

Read MoreZillow says Tampa Region Still a National Favorite – and Offers a Balanced Mix of Lower Pricing, Opportunities and Sustainability

Zillow says Tampa Region Still a National Favorite – and Offers a Balanced Mix of Lower Pricing, Opportunities and Sustainability Back to Blog February 3, 2026 Tampa and the surrounding region continue to draw attention as one of the nation’s top markets for home buyers, and that attention is balanced along with the need for…

Read More2026 FHBA Legislative Update – 1.22.26

2026 FHBA Legislative Update – 1.22.26 Back to Blog January 22, 2026 Florida Board Certified Construction attorney, and FHBA Government Affairs Chair Justin Zinzow will be providing weekly ongoing insights into the 2026 Florida Legislative Sessions. His updates will focus on how legislative shifts impact the construction industry and TBBA members. Click here for this…

Read MoreStability is the Word for 2026

Stability is the Word for 2026 Back to Blog January 20, 2026 The latest data from the federal government mirrors the 2026 predictions for the national and Florida housing market, and the forecast can be summed up in one word. Stability. The U.S. Department of Housing and Urban Development and the U.S. Census Bureau’s Jan.…

Read MoreInteresting Policy Making at Both the Federal and Local Government Levels Coming in 2026

Interesting Policy Making at Both the Federal and Local Government Levels Coming in 2026 Back to Blog January 5, 2026 It’s the time of the season to look towards 2026 and wonder what lies on the horizon for the homebuilding industry. One thing that catches the eye: Federal legislation may pave the way for increasing…

Read MoreNAHB Lends Conditional Support to E-Verify, the Federal Government’s Employment Eligibility Verification System

NAHB Lends Conditional Support to E-Verify, the Federal Government’s Employment Eligibility Verification System Back to Blog December 9, 2025 A move to require all employers to use E-Verify – the federal government’s largely voluntary employment eligibility verification system – is gaining momentum on the state and federal level. Nationally, the program is voluntary for most…

Read MoreStability Replacing Volatility in Housing Market

Stability Replacing Volatility in Housing Market Back to Blog November 18, 2025 Stability appears to be replacing volatility and panic is giving way to patience when it comes to the housing market in Tampa Bay and across the state. Mortgage Professional America (MPA), a leading B2B trade publication in the mortgage sector, recently reported that…

Read MoreRemodeling & Renovation Remains Dependable in Homebuilding Industry

Remodeling & Renovation Remains Dependable in Homebuilding Industry Back to Blog October 30, 2025 Remodeling remains dependable for the home building construction industry despite some indications it may be slowing. Harvard’s Joint Center on Housing Studies recently released a new report indicating that annual expenditures for improvements and maintenance to owner-occupied homes are projected to…

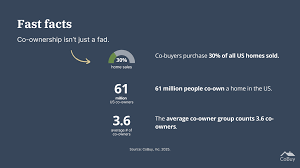

Read MoreA Rising Trend: Co-Buying

A Rising Trend: Co-Buying Back to Blog October 20, 2025 Co-buying homes continues to be a rising trend among the Gen Z and Millennial crowds, both for those young entrepreneurs looking to become real estate investors and friends searching for ways to manage the costs of homes. NPR recently chronicled the story of two California non-romantic…

Read More